Much has been written about the revolutionary potential of open banking: it’s ability to aggregate data and enable users to view all of their accounts in one place; the deep insights provided by bank transaction data which results in better analytics; and the empowerment of customers as a result of giving them complete control over who can access their data. These are all game-changers for sure, but one of it’s more overlooked assets, and one which could be of key importance at this time, is its ability to deliver financial data in real-time.

So why exactly is this such a big deal? And what advantages are to be had for financial service providers (FSPs) who have yet to fully embrace the PSD2 revolution? Let us look at the use of real-time data in the setting of credit risk assessments to get a better idea.

When an individual or small business goes to a lender for a loan, the underwriter generally relies on a number of tried and tested data sources to make their decision. These can be provided in either digital or physical formats, and include:

- Internal bank data

- Bank statements

- Credit bureau data

- Payslips

- Accountancy data

The problem with each of these sources is that the data is lagged. In other words, underwriters have to base credit decisions on data that can be days, weeks, or in some cases months old. For example, credit bureau data is lagged by one or two months. What if an individual has e.g. lost their job or suffered a similarly serious income shock during that time? Likewise, accountancy data is generally compiled quarterly, bi-annually or in some cases annually. This means business loan decisions could be being made using data which is almost a year out of date!

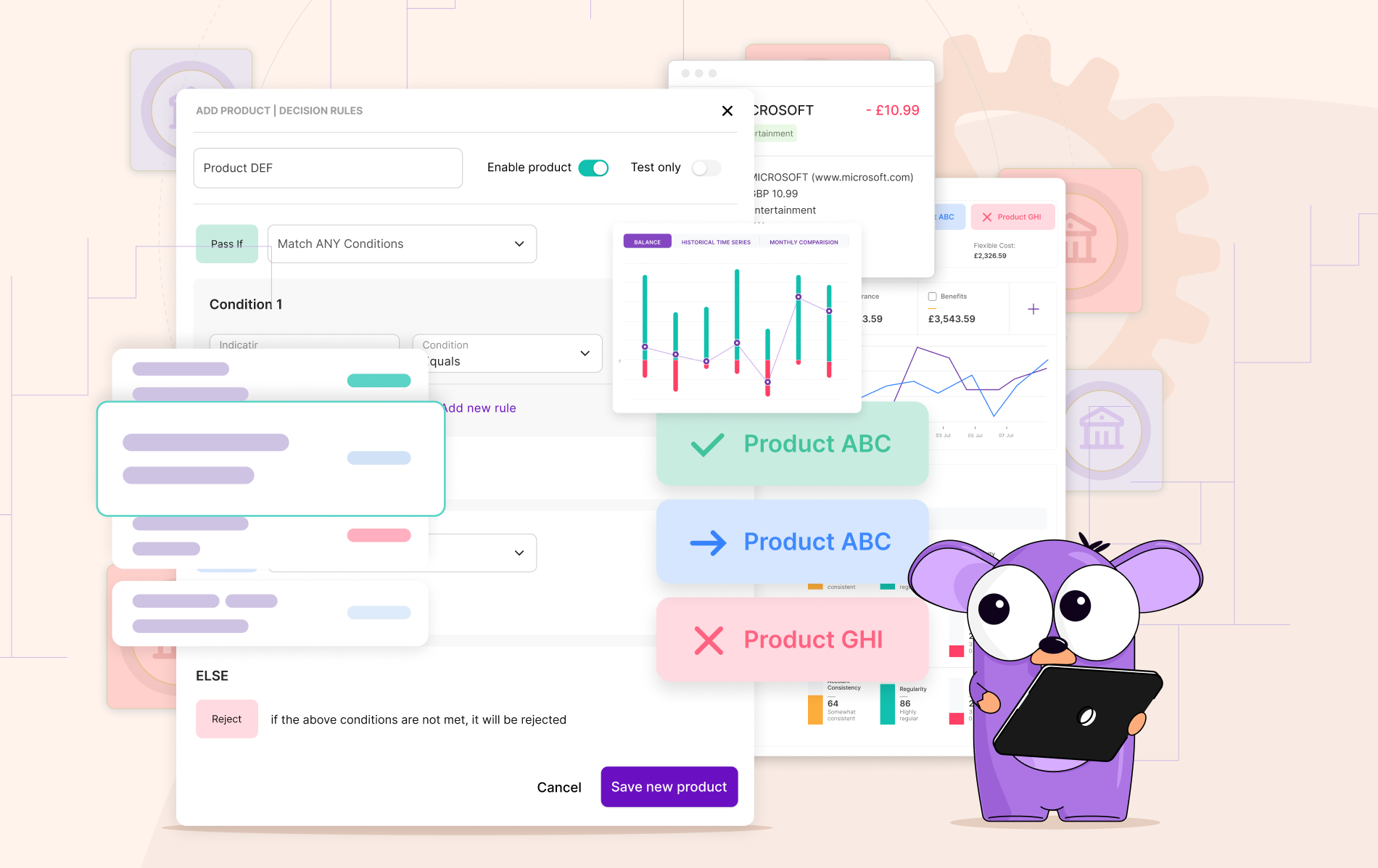

With open banking, all this changes. In order to assess the creditworthiness of a borrower, an FSP simply pings the API of their open banking provider (a process which amounts to nothing more than the click of a “refresh” button) and receives up-to-the-minute financial information about the borrower. This can include basic metrics such as income and expenditure breakdowns, along with more sophisticated analytics and insights into creditworthiness. Using such data gives underwriters the ability to make a wholly contemporaneous assessment of an individual’s credit risk.

The right product for the right customer at the right time

Whilst credit is certainly a necessity at present, lenders also have to manage their own risk. The real-time transaction data provided by open banking enables underwriters to make an informed, accurate risk decision based on the most up-to-date information available pertaining to the borrower. In addition, such data can help contextualise an individual’s financial situation, which helps FSPs to better match credit products to customers based on their present circumstances. This can be crucial in helping minimise any losses suffered by the individual or business in these tough economic conditions.

FriendlyScore offers a full open banking software solution to financial service providers which includes connectivity, analytics and creditworthiness assessments. To find out more, visit www.friendlyscore today.