Income verification has become a crucial element in assessing a potential borrower’s risk profile.

Businesses require a full picture of a client’s income to assess loan applications, however, traditional income verification is known to have numerous drawbacks. It’s a tedious and time-consuming process that requires physically collecting and reviewing documents. As income data isn’t reliable enough, it can be difficult to accurately determine a customer’s ability to pay. This is where automated income verification comes in – this API-powered solution verifies a user’s income in seconds, retrieving reliable data from trusted sources such as payroll.

What is income verification?

Income verification is a process that enables you to ensure that a potential customer/borrower can pay their mortgage or loan payment each month. It usually means analyzing various types of documents that a lender requires to decide on a borrower’s application.

An automated income verification makes the entire process much more efficient and scalable – you can process more applications in a shorter time, without human errors and manipulation. Planky’s Income Check uses an innovative, AI-boosted technology to further speed up the income verification process. It enables you to instantly process, digitize, and categorize an application, as well as obtain a report with a thorough analysis of your potential borrowers.

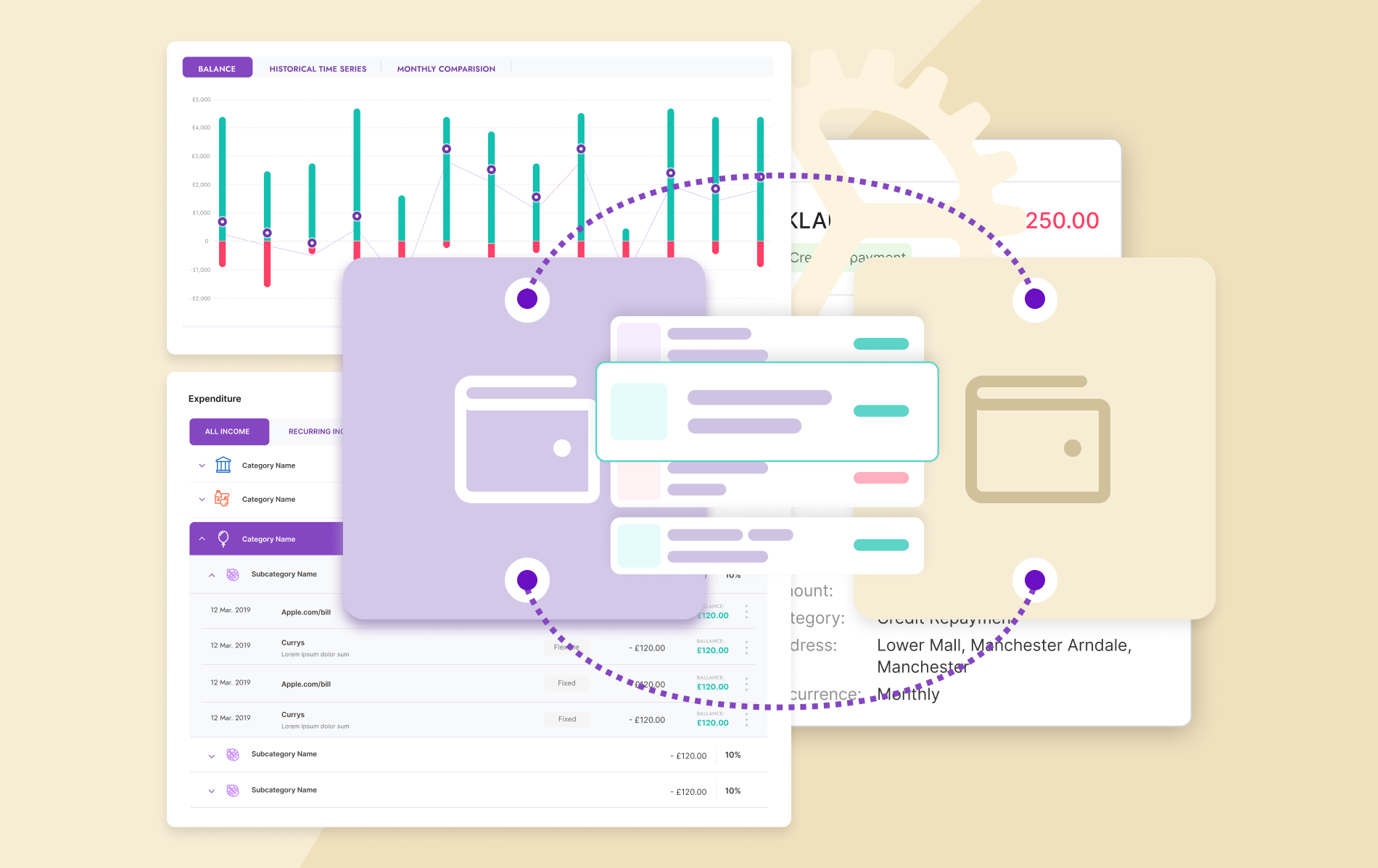

The tool verifies an end-user’s income by fetching real-time data from their bank account. The data is provided in a standardized, reliable, and classified format. Income Check can assess many types of documents that are common to traditional applicants (paystubs, tax returns, pension award letters, etc.), as well as those that are uncommon or non-traditional (bank statements, profit and loss reports, etc.).

How does Income Check work?

The Income Check tool is an easy-to-integrate solution that only uses a single line of code for you to connect it with your platform. Once a customer consents to share their data and authenticates to their bank, a report is made available to you in seconds. The tool can be used to identify actual income transactions and classify data. It collects transactional information from thousands of verified European banks which guarantees high quality and reliability.

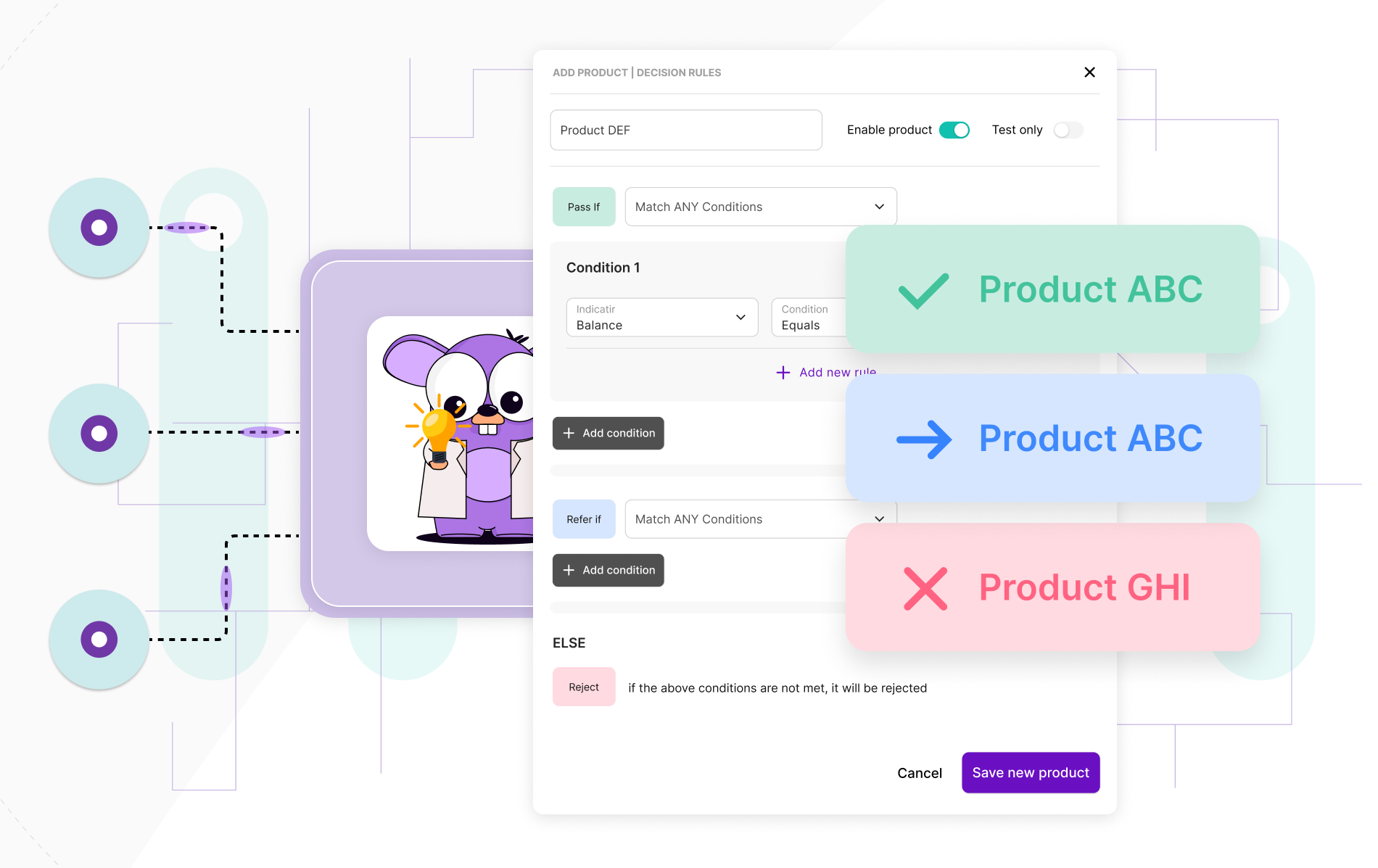

You may still wonder how the Income Check data is produced in practice. It’s innovative, yet extremely simple. There is a Machine Learning model that analyzes the bank data using a set of transactional features such as date, frequency, size, description, and stability. It analyzes all the transactions and their features to decide what type of income each transaction is. Then, it classifies transaction data as salary, pension, benefits, cash deposits., and many others – there are over 100 categories. You can use the predefined ones or even create new ones that better suit your requirements and needs.

It is worth mentioning that the model has been constantly developing. It is being updated using new transactional data which also includes adding new categories. Therefore, the performance is continuously improved. It is based on accuracy and precision. Accuracy guarantees the full understanding of certainty in the model. On the other hand, precision enables you to make sure that transactions that have been predicted as income are actually income. The higher the precision, the more we can trust the tool classifications of a user’s income.

The benefits of Income Check

The Income Check tool allows businesses to improve conversions by using existing processes their customers are already familiar with. No matter the type of income – traditional salary or gig – Income Check has got you covered. It allows you to verify a borrower’s income quickly and gain deeper insight into the nature of their income.

What else? What are the most relevant advantages of using the tool?

1. Automated income verification is a perfect way to significantly increase the number of applications. No type of applicant cannot have their income accurately verified.

2. It speeds up the underwriting process.

3. You get real-time access to income data. You are notified of changes to your customers’ incomes or jobs which offers dynamic insight into their finances. Therefore, you can provide more personalized services and personalization, in turn, improves customer engagement.

4. You can minimize the amount of manual labor in the application review process which increases loan originations.

5. Income verification for self-employed applicants is streamlined and easy as never before.

6. The risk of fraud and default is reduced. No more inflated income statements, fake paystubs, and misrepresented employment status. When using Income

Check, you receive the income data directly from the payroll platform. There is no room for synthetic identities, fake employers, or fraudulent income statements.

7. You can lower origination costs. You don’t waste time and money on repetitive, manual tasks as approximately half of the tasks across front-to-back processes are automated.

Ready to leverage income verification?

Planky offers the latest technology that allows businesses to take income verification a step further by providing a data-driven analysis of a potential borrower’s creditworthiness. We use a proprietary modeling framework that uses a dedicated salary detection model that boosts salary detection performance and brings it in line with general classification performance. As a payroll connectivity API provider, Planky supports FinTechs in streamlining the income verification process. Once integrated, your customers can easily use the tool to log into their payroll platform and grant access to their data.

Interested? Book a demo!