In today’s world, data is definitely one of the most valuable assets for businesses. In the financial industry, where there is no transaction or interaction without a digital trail, information is crucial if you want to drive business growth and success. Companies that enrich financial data can make more informed and personalized decisions. However, many institutions are still struggling to better understand their customers’ financial information.

What is data enrichment then? How does it enable financial companies to cater better to the needs of their customers?

What is data enrichment?

If you want to keep your customers satisfied with your financial services, you need to really know their needs. In fact, many companies, including banks, often lack a holistic view of customers’ financial engagement and transactions. Extracting value from raw data and making the most out of it can be extremely tough and requires competencies, time, and money.

This is where data enrichment comes in. It’s a process of adding additional information to the transactional data that already exists to make the data more valuable and informative.

The process can help financial and lending companies increase their revenue by improving customer service and enabling them to build products relevant to customers based on their specific needs and desires. Data enrichment can proceed for a variety of purposes, such as improving the accuracy of financial analysis, complying with regulatory requirements, enhancing the user experience, etc.

As for its use cases, you can apply data enrichment to:

- Banking and lending.

- Investments and risk management.

- Real estate.

- E-commerce.

- B2B businesses.

Real-life example: rather than just knowing that a customer made a $100 transaction, with data enrichment, you can receive information that indicates the transaction was made to cover a particular expenditure category. For example, you would know that a customer is a career-oriented individual investing in personal growth. This allows you to personalize your services and target your target audience better.

What are the benefits of data enrichment?

According to Acumen’s data, the data enrichment solution market will reach $3.5 billion by 2030. First and foremost, data enrichment helps lenders and banks have a deeper understanding of customers’ finances. It enables the financial industry to improve the accuracy and usefulness of information. Also, it helps analysts and decision-makers make better-informed decisions about financial products and business strategies.

Below, you will find the most relevant benefits of data enrichment from a lender’s point of view:

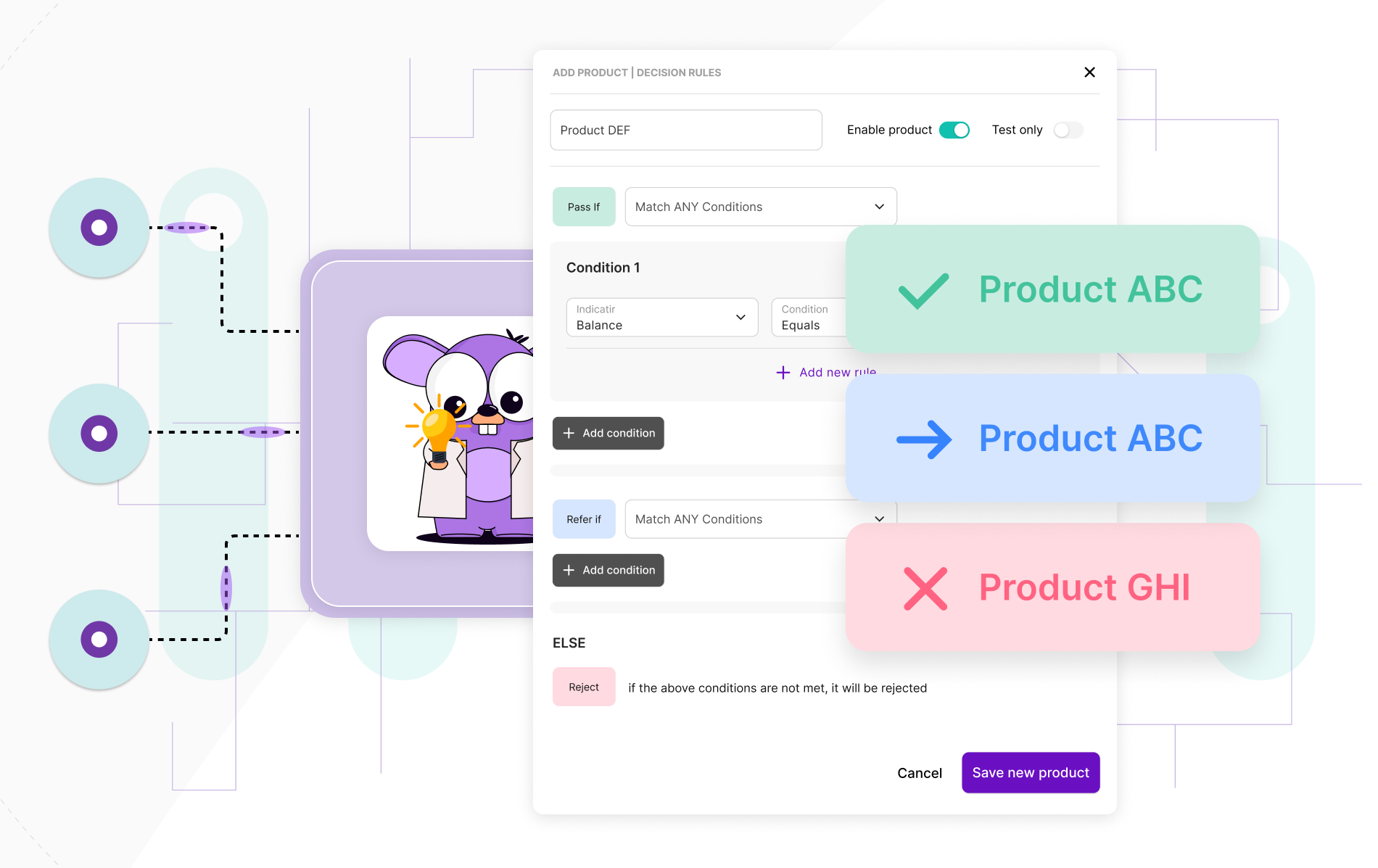

- It improves decision-making processes – you get a full picture of your customers’ transactions. No matter if you need to decide on market expansion or launching new products, it’s easier with detailed, valuable data. Data enrichment also enables a better understanding of risk because you can identify early signs of customers’ financial distress.

- You get access to accurate and reliable data. As financial information features the most up-to-date information, you don’t miss out on sales and make incorrect business decisions.

- You can create better customer profiling by adding many demographic details such as age, income, and marital status, to customer profiles to hyper-personalize your products and services. The data you collect can help you understand their preferences and draw accurate conclusions to build a better customer experience which leads to the increase in the likelihood of repeat custom.

- Cost reduction is simpler. You can avoid costly errors.

- You gain a competitive advantage by staying ahead of the competition – you can easily identify market trends and understand customer preferences.

- ROI on your marketing campaigns skyrockets. By adding a new layer of information to your data, you can create highly targeted marketing campaigns. This leads to greater relevance and effectiveness in marketing communications and, in consequence, to increased sales and revenue.

Transactional Intelligence – Data enrichment by Planky

Transactional Intelligence is a data enrichment tool that provides companies with detailed account analyses based on real-time banking data. It uses over 150 metrics, as well as alert and notification features to help you access a customer’s account and further analyze their transactional information.

All transactions thoroughly analyzed

You can easily monitor a customer’s account through API. You get instant access to income sources and expenditures divided into customizable categories. You can also look at historical values and recurring payments in the last 12 months and future predicted values.

Financial markers and indicators

Credit repayments and loans were never this easy to analyze. The tool uses metrics based on amounts, proportions, and number of incidents. The indicator list includes activities such as Debt Management, Child Benefits, Collection, and more.

Pattern and anomaly detection

Transactional Intelligence helps you jump into the predicted transactions for the next 90 days. You get real-time alerts and notifications every time any anomalies occur. This allows you to proactively act toward your customer’s current financial situation and credibility.

More about Transactional Intelligence

The platform is powered by Artificial Intelligence that uses advanced ML algorithms to provide an enriched insight into financial data and risk. The accuracy in transactional data categorization reached over 95%. The transactions are analyzed multiple times a day so that you can be certain that the data you get is in real time. You both optimize time and money and reduce the risk of human error.

Choose the right transaction data enrichment provider

Choosing the right partner for data enrichment processes may be tricky. You should make sure that the provider has access to high-quality data sources – data quality is crucial as it determines how accurate and reliable the data is. Planky’s Transactional Intelligence has been powering financial and lending businesses using real-time data delivered from trusted European banks, providing speed and flexibility and improving efficiencies. Ready to try? Let’s talk!