The role of proper loan decisioning is now more crucial than ever. However, manual verification of a customer’s affordability and credibility is both expensive and time-consuming. Also, it’s prone to human error. In consequence, financial institutions and lending companies have been looking for quick, accurate, and high-quality services that are fully automated and manipulation-free.

Automated credit decisioning means the sheer speed of processing loan applications which leads to immediate responses to loan requests. When you add the precision of advanced Machine Learning algorithms, you’re ready to go.

What is credit decisioning?

Credit decisioning is one of the most important steps in the loan or credit process. It is assessing a credit or loan applicant’s creditworthiness before extending payment terms to a new customer or increasing the credit limit of an existing customer. It’s worth mentioning that making sound lending decisions requires harnessing huge amounts of data from multiple sources.

How is automated credit decisioning better?

Traditional decisioning processes involve both the credit applicant and the loan provider navigating various application forms and documents. This obviously results in long approval or denial decision times. It’s extremely costly for lending companies and frustrating for customers who don’t want to wait longer than needed to get the decision.

On the other hand, automated credit decisioning offers intelligent analysis, and powerful insights based on real-time transactional data. AI-powered credit decisioning tools streamline the approval process, minimize the administrative burden, and speed up loan application operations. Financial companies get improved approval rates for qualified applicants and reduced risk of fraudulent activity.

Risk assessments become more reliable when you get a holistic overview of your customers’ finances and better insights into potential risky patterns, don’t they?

Decisioning engine – automate credit decision-making

Instead of spending days or weeks on manual data analysis, more and more lenders have been automating workflows and operations using AI-powered automated credit decisioning such as Planky’s Decisioning Engine. Automated loan decisioning refers to the process where you use innovative technology to verify applicants’ creditworthiness without (or with minimal) human intervention. Such a system is built around data input, processing Machine Learning algorithms, decision rules, and output – the final decision generated along with certain conditions.

Simply speaking, you just set any parameters you need for approval or denial for your service, and the credit decision is made automatically.

Platforms such as Decisioning Engine utilize various technologies that make credit decisions as accurate as possible. They are based on:

- Artificial Intelligence and Machine Learning.

- Decision algorithms.

- Advanced data analytics.

With Planky’s Decisioning Engine, you can build your own credit rules to fully optimize decisioning processes. Everything is easy and automated – workflows are automatically added to customers’ accounts. The data you get is real-time and accurate, without the risk of fraud or manipulation.

How does it work?

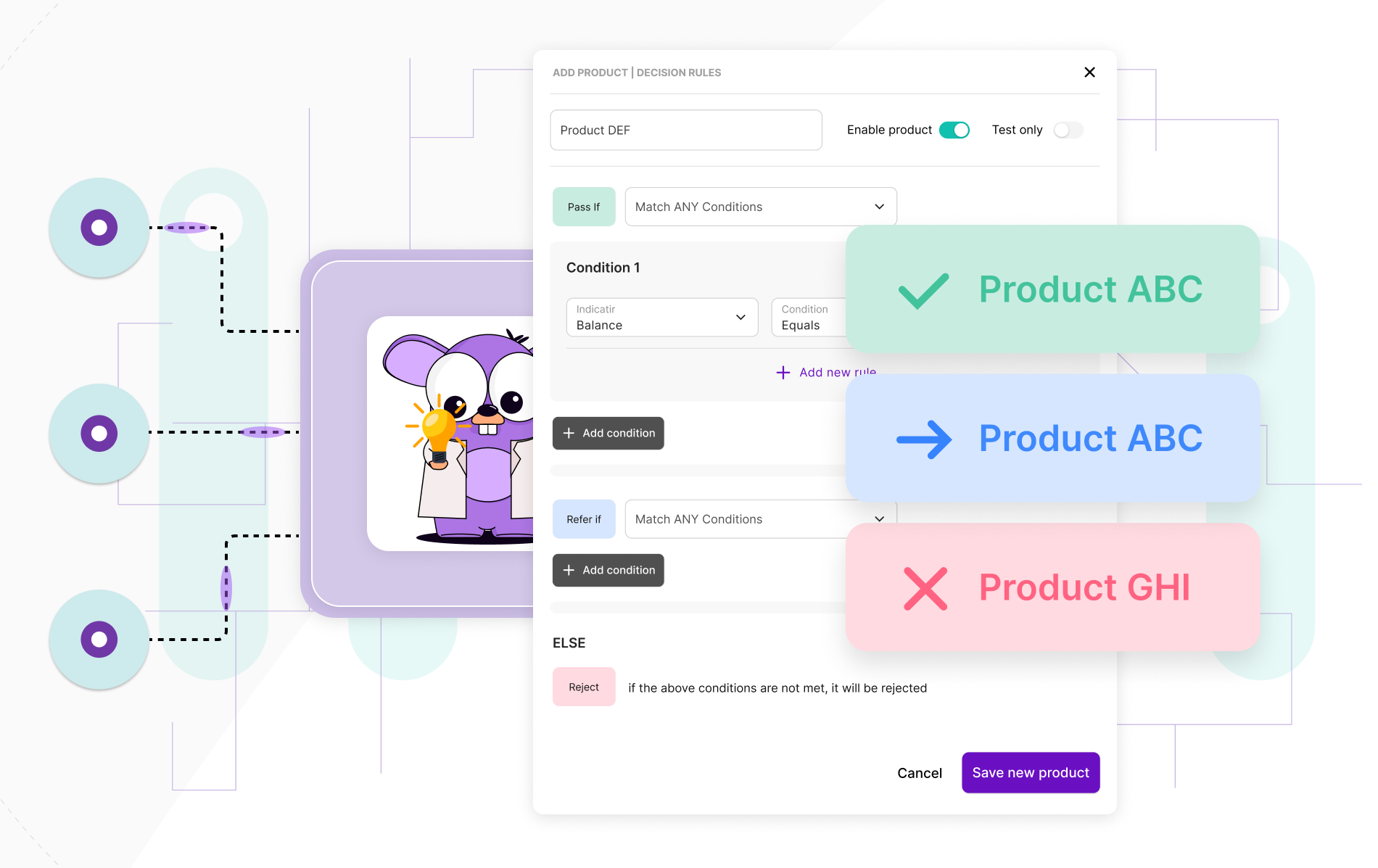

Decisioning Engine gathers and analyzes all relevant components and metrics to finally provide a 100% accurate lending decision. When setting up your decision process, you need to add the products that need financial data assessment, then you define conditions and decisioning rules. The most common customer statuses are ‘Pass’ (positive decision), ‘Refer’ (needs further review), and ‘Reject’ (application rejected). The process takes seconds to complete.

Decisioning Engine can be used for all financial products such as mortgages, leasing, student loans, and more. There are over 150 variables to classify and analyze transactional data that is delivered directly from the banks.

Why switch to Planky Decisioning Engine?

Automated credit decisioning can be highly beneficial for a lending company. It differs significantly from manual processes – automation drastically reduces the time taken to make a decision and eliminates the risk of human error which leads to more accurate assessments of credit risk. Here are the most important benefits of an automated Decisioning Engine:

1. Decisioning processes are smarter and more accurate. Having data is one thing but the proper use of it is another. The engine extracts the value from financial information, as well as finds patterns and anomalies. Decisions are made based on spending behaviors and income sources.

2. Credit loss rate decreases. Decisioning Engine uses models that accurately determine applicants’ likelihood to default. This impacts the levels of provisions and capital you must hold.

3. The tool can easily handle a high volume of applications without the need for more resources. Scalability pays dividends in higher revenue.

4. Customer experience is better – it doesn’t require much paperwork but still brings near-instant results. On the other hand, you can understand your customers and their spending behavior better which supports you in building more customer-oriented products.

5. Efficiency increases – you automate manual processes through automation. Also, your employees can focus on more strategic areas. As you use an intelligent scoring system, you can make better and faster credit decisions.

Start using Decisioning Engine right away

Planky has been designed to support financial and lending businesses in processing simple and easy affordability checks. We want to create the best experiences for both our customers and target audiences that use their financial products. Decisioning Engine makes the underwriting process much easier and accurate, relying on verified data and AI-powered algorithms. It enhances your ability and risk assessments so that you can bring your lending processes to a completely brand-new level.

Interested? Contact us to learn more or book a demo to try the solution right away!