If you need to automatically access all financial assets without submitting multiple copies of physical or scanned documents, you must have heard about account aggregators. If it doesn’t ring a bell, time to change it - account aggregation is a perfect way to streamline underwriting processes by providing digital verification capabilities. How does it work? How can it be beneficial? Let’s find out!

What is account aggregation?

Account aggregation is the process of gathering information from different financial accounts into one single platform.

Such a platform pulls these finances together to provide greater visibility over one’s finances. An account aggregator enables businesses to connect and access various checking accounts, savings accounts, investment accounts, mortgages, credit card accounts, and much more.

How does account aggregation work?

An account aggregator fetches data such as balances and spending information from various bank accounts owned by a user. Usually, companies use one of the following ways to enable their customers to link their financial accounts:

- Open APIs – customers access their financial data using tokens, instead of sharing their credentials.

- Screen scraping – the process of collecting data from one source by inputting user credentials and displaying it in another application.

Customers often wonder if account aggregation is a safe process. In fact, it is highly secure as customer information is authenticated with a user’s bank. The data isn’t shared with any third parties which reduces the risk of fraud. Access to financial data is secure and the service provider doesn’t see more data than a user may want to share. Finally, customers can revoke their permission to share their financial data at any time

What are the advantages of account aggregation?

Account aggregation can bring a lot of benefits, from both a customer’s and business perspectives. Business owners will especially benefit from the following:

- Account aggregation is a great way to get better financial overview of the company. On the other hand, providing aggregation to customers can be a good way to engage them more and keep their attention and loyalty.

- You get increased transparency over your customers’ finances. This, in consequence, helps you make more accurate credit or risk assessments.

- Having instant access to the full picture of customers’ finances saves time and increases efficiency.

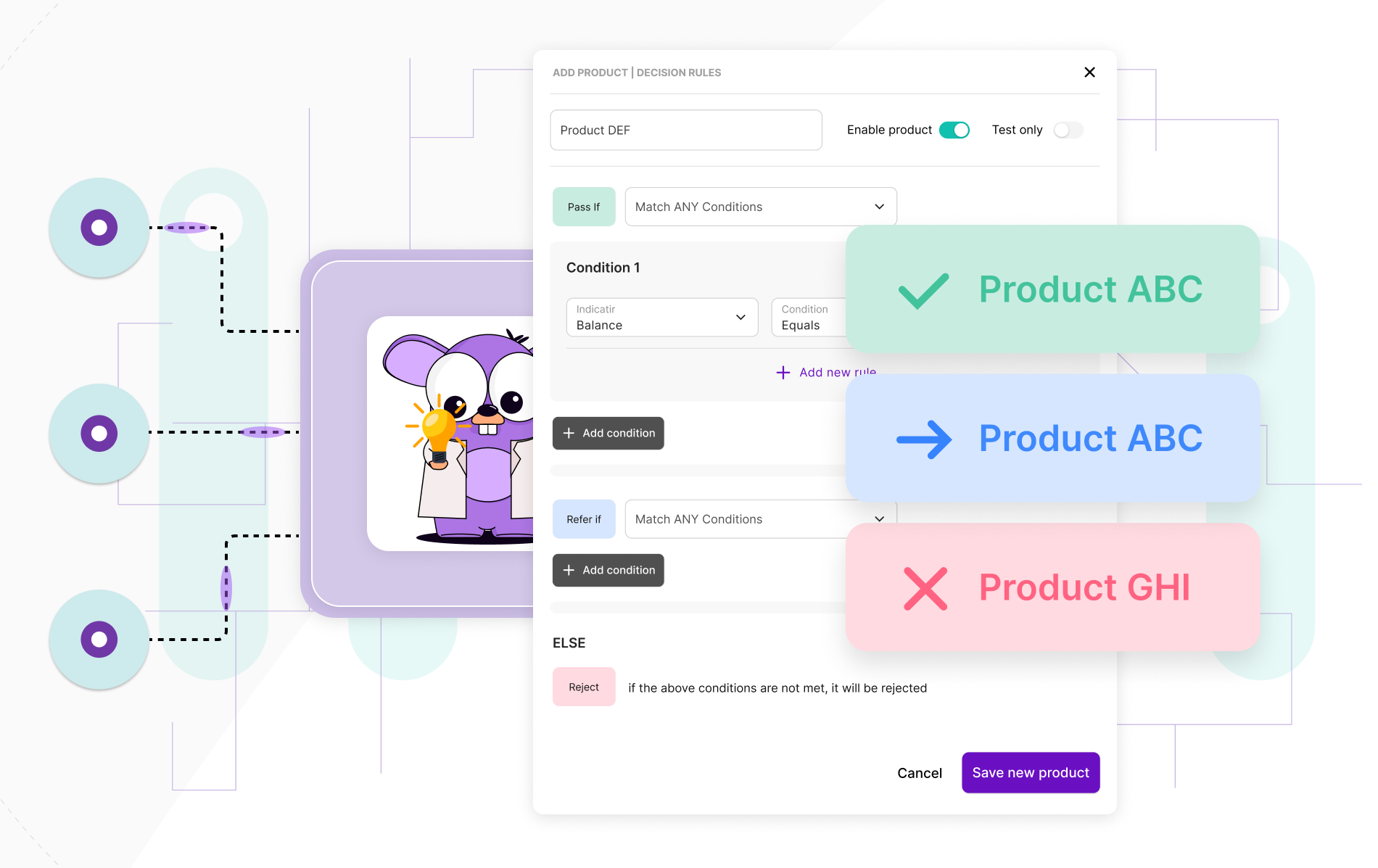

- You can provide a better user experience in your digital channels, mainly through an opportunity to build highly personalized services. You are able to offer products your customers are more likely to use. This leads to increased loyalty and higher engagement.

- Account aggregation speeds up onboarding processes, while still meeting all regulatory needs. The result is a faster and cheaper onboarding process, as well as better customer service.

- Account aggregation allows you to provide highly personalized recommendations and cross-sells. This leads to higher revenue. Also, your services may be more accessible to people without traditional credit histories which means increased profitability.

And what about the customer’s perspective? The main benefit is obviously the fact that account aggregation helps people see all their different accounts in one place which is extremely helpful when they have their money spread out through various accounts. This makes managing financial data much more straightforward for their users. It saves their time, effort, and money as they don’t need to update data manually or log into multiple accounts individually. Finally, customers have the opportunity to benefit from more personalized features. As companies better understand their needs, customers are provided with better financial products.

Are there any risks related to account aggregation?

The first thing that comes to one’s mind is of course the security of such software. The crucial decision to make is choosing the right account aggregation tool provider. When you choose the right business partner, account aggregation is 100% safe. It enables businesses to verify and aggregate financial information without sharing their sensitive information. This makes the entire process secure for both the user and the service provider.

Start making the most out of account aggregation

Account aggregation is beneficial for both individual customers and businesses offering financial services. Customers can better control their finances kept in various bank accounts, and companies can offer better, more personalized services, and boost both efficiency and revenue. Financial data can be reached in a cleaned-up and standardized format. Also, it is easier to verify customer’s income and transactions for better and more efficient underwriting processes.