Risk assessment has been evolving in the last few years; however, the core principles haven’t changed. These are stability and ability to pay, boosted by the availability of data and improved processing capabilities. During the COVID-19 pandemic, the need for more accurate and real-time customer data turned out to be more crucial than ever. This is where CaaS (Categorization as a Service) may be a missing puzzle.

It simplifies the transactional data provided by the bank to better understand customers’ incomes and expenditures.

What is Categorization as a Service and how does it work?

CaaS is a service that enables businesses to understand customers and their personal finances. It is a perfect way to understand what your customers can afford to borrow and what they are able to repay.

The solution automatically categorizes all customers’ bank and credit card transactions into over 100 categories with excellent +95% accuracy. This helps you understand the sources of customers’ incomes, expenditures, as well as spending behavior. The data is real-time, confirmed directly by the bank which makes it accurate and reliable. The categorization gives businesses an opportunity to make use of valuable financial insights into the credibility and affordability of their customers.

How does CaaS work?

CaaS is driven by Artificial Intelligence and Machine-Learning algorithms. It automates the process of bank data categorization. It’s a pre-trained technology that processes a customer’s account information and instantly identifies the type and purpose of a transaction. It is trained on millions of data entries using advanced algorithms. The algorithms used data such as:

- Transaction description.

- Transaction amount.

- Date.

- Contextual data.

The data can come from various sources – simple examples are open banking data, debit and credit card transactions, and bank statements. Based on the data above, the platform automatically assigns transactions to categories such as rent, payroll, costs of goods sold, utilities, and many more.

On top of categorization, the tool automatically generates valuable insights, based on categorized data, that enable companies to make better-informed decisions and know their customers better. The data is available for use in a batch on the cloud. The algorithm is continuously improved over time so that the tool can recognize new payment types, merchants, and consumer trends.

The benefits of Categorization as a Service

Transaction categorization can bring multiple benefits to your business. It ensures that the data is organized and analyzed much faster which makes the interpretation easier and more effective. What else can you expect when you partner with an experienced CaaS provider?

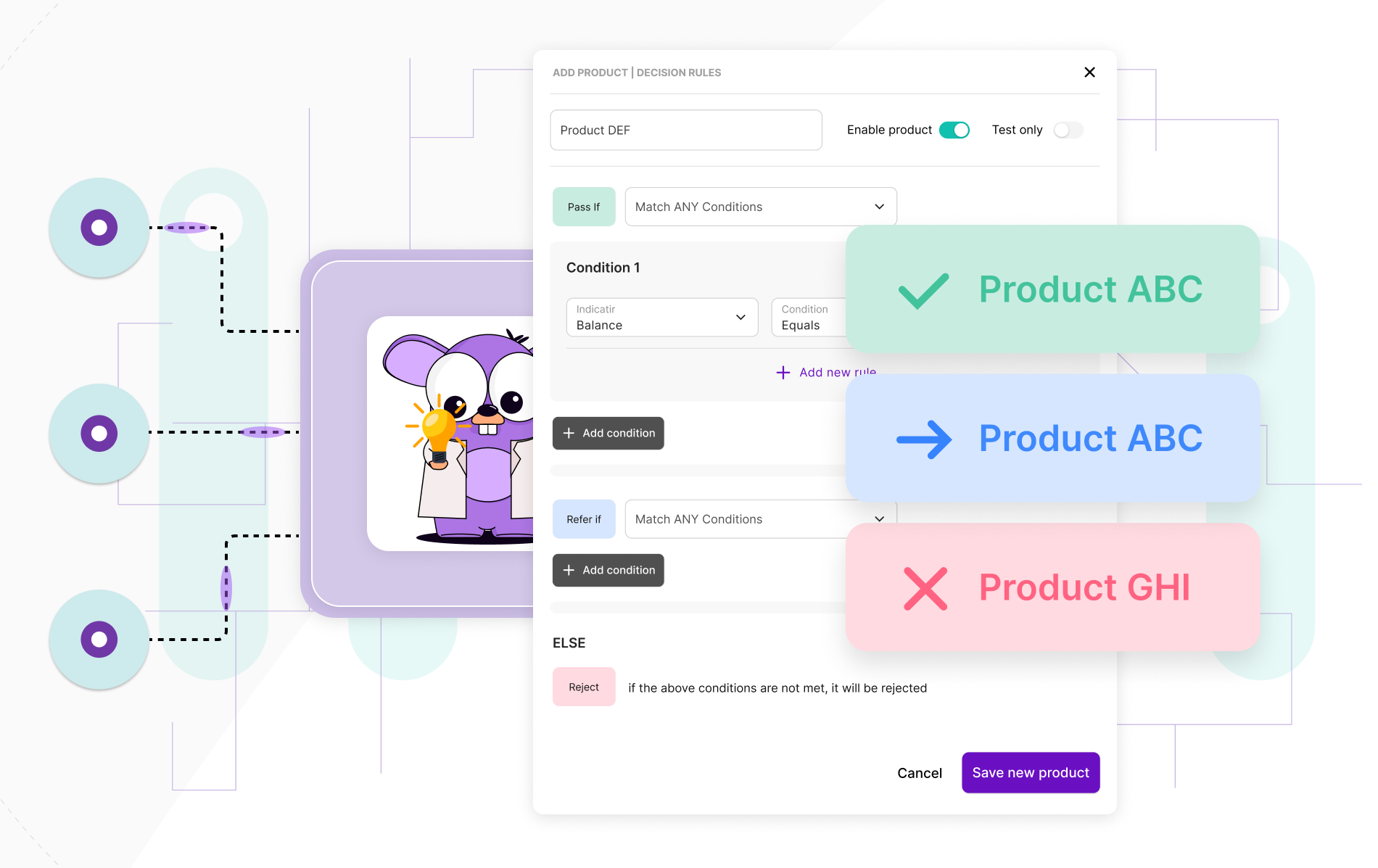

- You get a perfectly holistic view of your customers’ financial situation and affordability. It is possible to drive better outcomes for them thanks to pre-qualify eligibility for services and products. You get an accurate view of a customer’s finances based on what they earn, spend, and save. In turn, you can offer the right products at the right time

- You can quickly identify trends and opportunities for efficiency gains and cost reductions. Also, finding anomalies is easier and more cost-effective.

- You maximize your revenue because you are able to accept more applications. At the same time, you can easily cross-sell and up-sell to existing customers or extend their credit limits.

- You can reduce underwriting time and at the same time, boost decision-making. Proactive customer management also means better identification of vulnerabilities which leads to the reduction of delinquencies. As large amounts of data are automatically analyzed, you can focus on the customer’s financial behavior. This saves time and provides additional insights to inform decisions.

- Your business grows faster, and operational costs are reduced. You can proactively manage risk and stay compliant by monitoring risk across your customer portfolio.

- Your customers can plan their budgets better and more efficiently because it is easier for them to track category budgets. Also, they enjoy better customer experience with real-time insights, triggers, and alerts.

- Customers benefit from a more personalized experience and quicker customer service as many strenuous processes are automated and free of human error or manipulation.

CaaS for customer and business underwriting

Categorization as a Service is a way to get access to a variety of valuable insights which allows you to automate your understanding of your customers’ finances. The insights include income information, balance insights, employment sector, credit card behaviors, as well as account usage. As understanding the volatility in consumer’s financial capacity and the ability to recognize trends from consumer transactional data have been crucial to acting appropriately, CaaS has become more and more popular across the entire credit lifecycle. The service creates value by providing a deep insight into an individual’s finances, and by managing liquidity risk. Categorization helps lenders to make accurate decisions on the eligibility and credibility of customers immediately.

As you can automate the data capture, categorization, and verification, you can better understand the individual’s personal circumstances. CaaS improves the accuracy of decisions and ensures that customers receive products and services that suit their needs and financial situation. Finally, you can improve how you communicate with your customers and deliver better products, more attuned to what your customers can afford. At the same time, thanks to insightful triggers and alerts will help you with proactive customer management and risk monitoring. For instance, early warning indicators can notify you about customers who fall into debt and allow you to take fast and appropriate action to minimize losses.

Why is the Planky Categories tool the best?

Planky’s Categories supports businesses in making the most out of utilizing bank transactions. It allows companies to turn messy transactional data into enriched insights with much relevant information, presented in an easy-to-follow dashboard. The categorization engine is based on laser-accurate, real-time data sourced granularly. It is over 95% accurate and allows for customization – you can use the existing categories or create your new ones, according to your needs.

Ready to try? Book a demo!