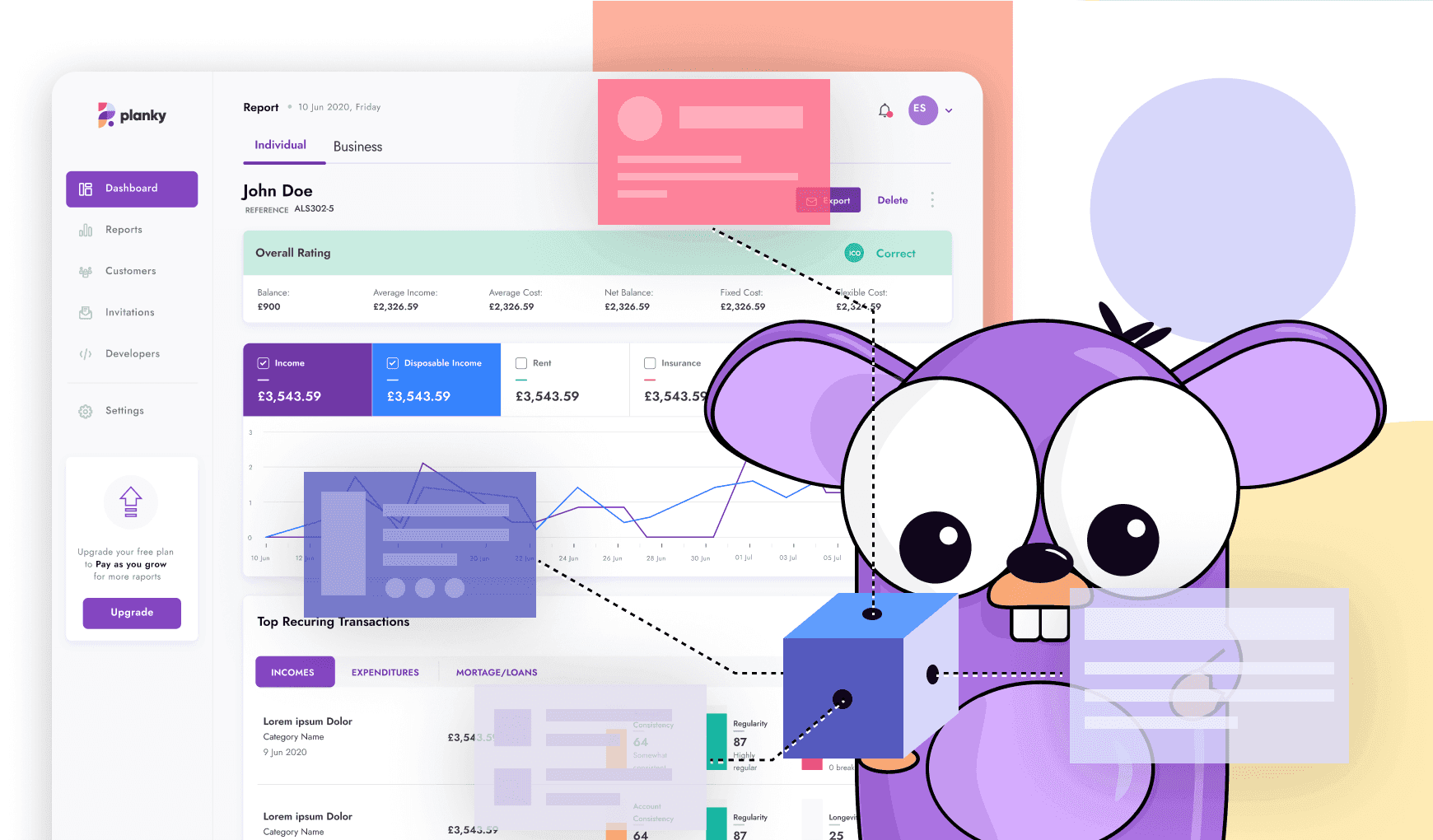

Planky New Features!

Emilian Siemsia

At Planky, we continuously work hard to keep innovating, improving and transforming our open banking solutions to benefit you and your business

That’s why we’re delighted to announce our new exciting features.

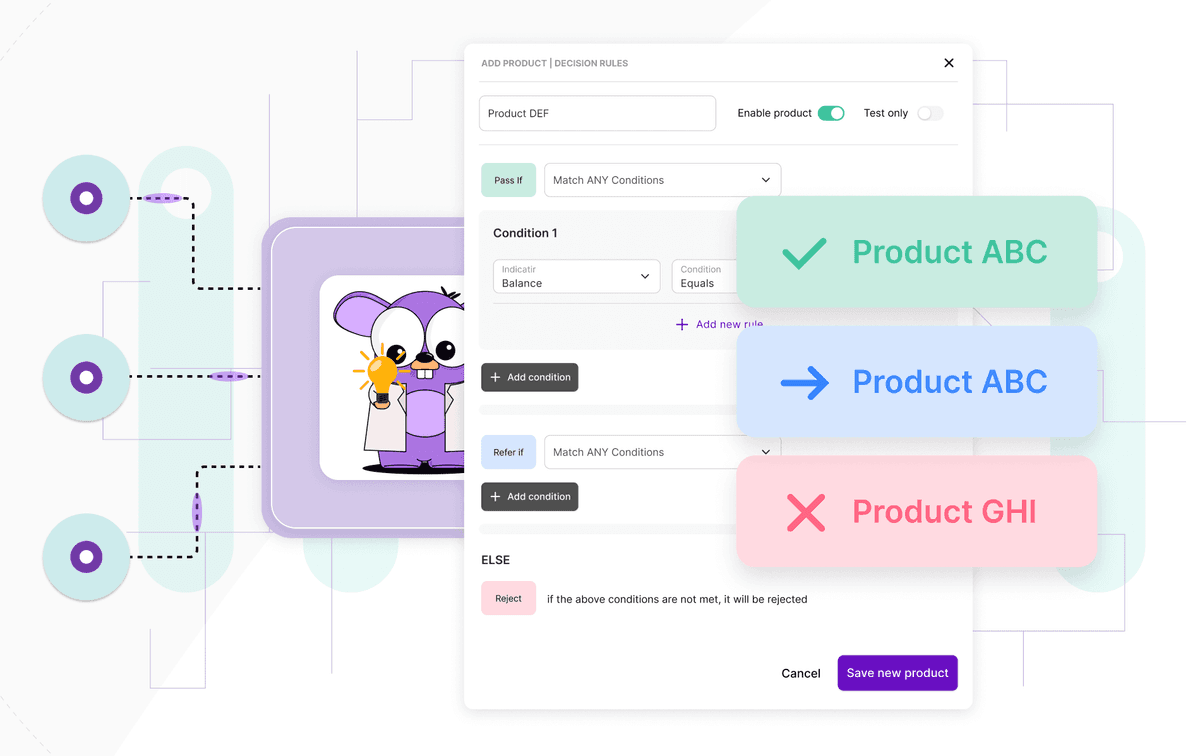

An improved credit decision tool

- We’ve incorporated 120+ indicators to ensure the most accurate credit decision

- Fully automated decision making based on client account data

- Automated underwriting

- Decision making in just seconds

- Reject or accept your customers based on their data

New weighted affordability / disposable income tool

- Apply affordability weighting to each income and expenditure category

- Take full control in how your customer’s disposable income is calculated

- No more ‘black box’ affordability calculations

- Incorporate your definition of affordability into the credit decision making process

Daily events notifications

- Daily alerts and event notifications

- View an aggregated list of events across your whole portfolio

- Easily monitor your customer’s high priority daily activity

Portfolio aggregated monthly statistics

Once a month you will receive aggregated statistics about your portfolio:

- Monthly aggregated portfolio statistics

- Invitation conversion rates

- Credit related activity

- Gambling related activity

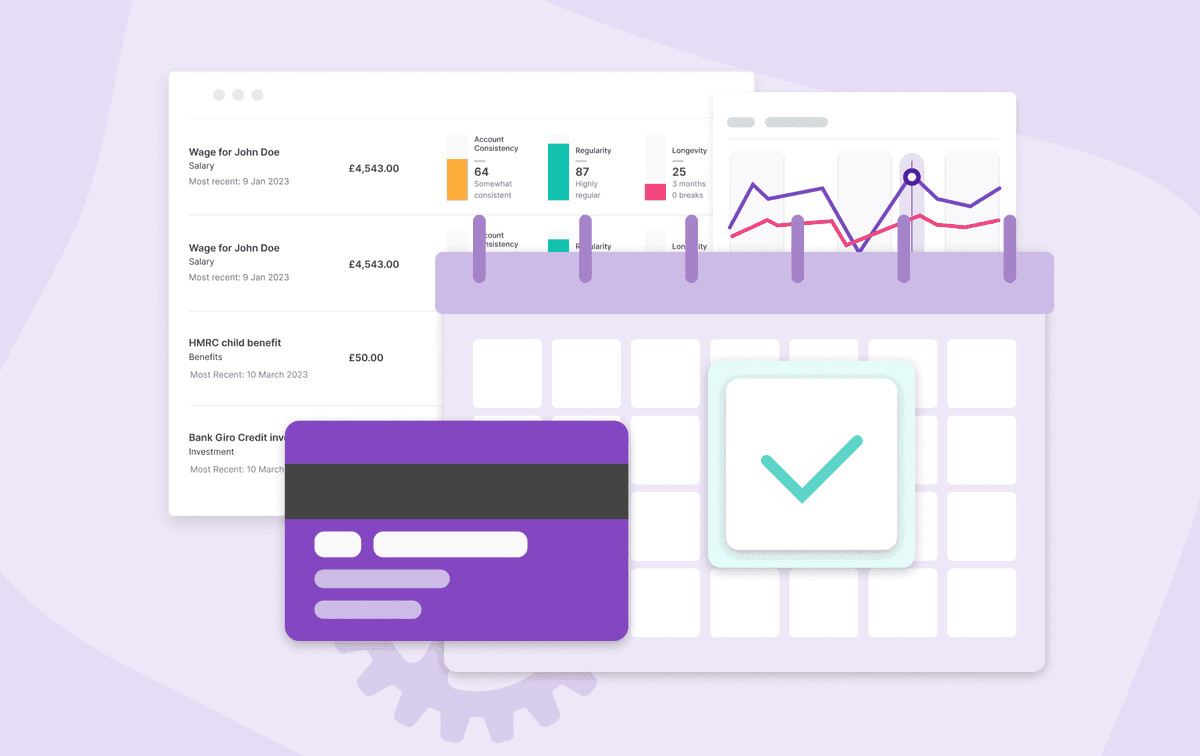

Improved salary detection model

- A new iteration of our salary model detection that combines machine learning and Natural Language Processing

- Delivers a minimum 87% accuracy in salary and gig economy salary detection

Discover our innovative, exciting Planky open banking solution! Contact us now!

Other posts in this category

Emilian Siemsia

How is AI used in financial analysis?

AI and LLMs automate credit scoring, enhance risk management, and streamline lending for finance.

Emilian Siemsia

What is Income Check and how does it work?

Automated income verification delivers fast, accurate, and fraud-proof data for smarter lending decisions.

Emilian Siemsia

Decisioning Engine – make smarter business decisions effortlessly

Automated decisioning engines deliver fast, accurate, and data-driven lending decisions for financial firms